Our Products

Satin Creditcare offers diversified financial solutions designed to empower underserved communities. Our diverse range of products fosters financial inclusion, supports economic growth and helps individuals and families build a sustainable and brighter future.

Empowering Lives Across Pan India

A robust and expanding distribution network dedicated to providing customized financial solutions for over 3.4 million clients across India

States & UT’s

29

No. Of Vilages

90,000

No. Of loan Officers

11,509

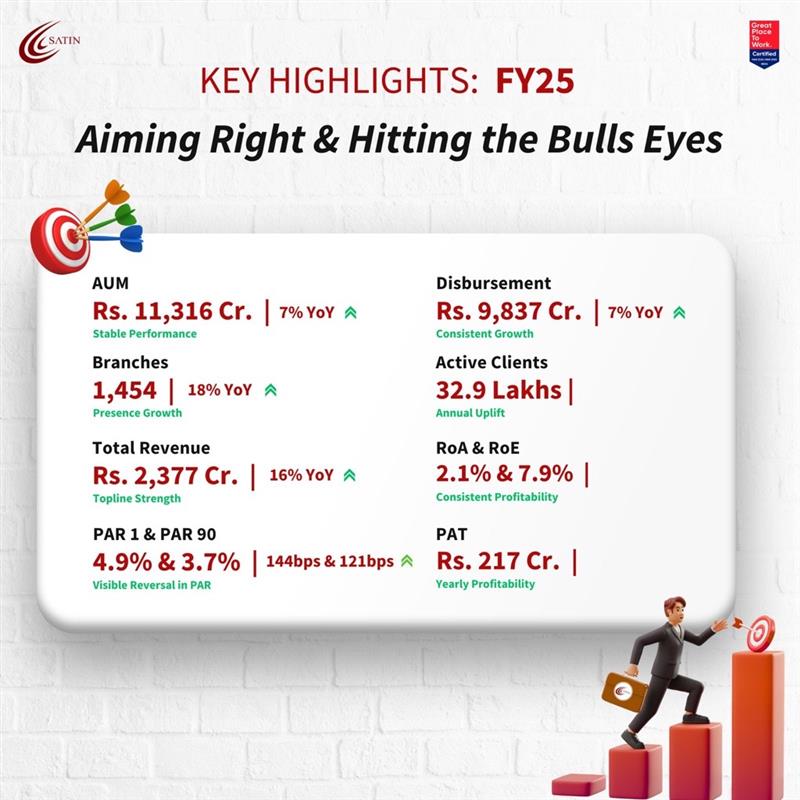

Chairman's Message

Dr. HP Singh

As the trusted financial provider for millions of households, at Satin Creditcare Network Limited, we have cemented our status as the leading NBFC-MFI primarily serving rural India. We have relentlessly fortified our position by championing financial inclusion and fostering development in underserved communities.

The Change We Inspire

SATIN Empowers

We remain focused on driving financial inclusion, underlined by our strong commitment to achieving socio-economic progress of low-income communities. SATIN, empowering more than 3 mn women entrepreneurs across India

Awards & Recognition

SATIN is a consistent early adopter of a host of industry best practices, sustainability measures, and pro-people initiatives. These have attracted industry recognition from time to time, and here is a brief highlight of some of the major awards we won over the past years.

Call Us

0124-4715400

Email

info@satincreditcare.com

SCNL Corporate office

Plot no. 492, Phase III, Udyog Vihar,

Gurugram