Our Milestones | Genesis | Growth

Company Timeline

Satin is One of the Leading NBFC MFI in India has been Constantly Progressing.

1990

Date of inception – Oct 16, 1990

1996

IPO and listing on DSE, JSE and LSE 1

1998

Registers as NBFC with the RBI

2008

Started JLG Model in May 2008

2009

JLG business shows strong asset quality and large potential to scale up

2010

Reaches 0.17 million active clients and gross AUM of ₹1,690.76 million as on

2011

Receives MIX Social Performance Reporting Award at Silver level

2012

Starts SHG bank linkage program in Rewa, MP Receives 83% in microfinance COCA audit-

2013

Reaches 0.49 million active clients and gross AUM of ₹5,800.26 million in March.

2014

Converts to NBFC-MFI in November of the same year. Receives MFI 2+ rating by CARE

Reaches 0.80 million active clients and gross AUM of ₹10,560.55 million by March.

2015

Listing on NSE, BSE and CSE2; Received top MFI grading of MFI 1

2016

Started MSME Lending and Individual Micro Loans in FY17; Acquired TSPL in Sep’16

2017

Incorporates HFC in April and reaches 2.62 million active clients and gross AUM of ₹44,931 million in September.

2018

Started HFC Leading in feb 18; Entered in BC agreement with Indusind Bank, reaches gross AUM of Rs 57,568 mm by Mar’18

2019

Received NBFC license for Satin Finserv Ltd for MSME business; reached AUM of 1 Bn USD; TFSL became wholly owned subsidiary

2020

Received the Award of “Great Place to Work”

Investment Timeline

With AUM of $1 Billion, Satin Creditcare has Gradually Turned into a Reliable Financial Service Provider in India to the Economically Weaker Section of Society.

2008

First private equity investment — Raised ₹ 48.74 mn from Lok Capital Captial; Rs. 10.00 mn infused by Promoter Groupe

2009

Raised Rs. 19.42 mn from Lok Capital

2010

Raised Rs. 25.08mn from Lok Capital in Nov’10 and Rs. 218.50 mn from ShoreCap II in Dec’10 Rs. 77.50mn infused by Promoter Group

2011

Raised Rs. 180.50 mn from Danish Micro Finance Partners K/S (DMP) in Feb’11

2013

Raised Rs. 300.00 mn from DMP, Shore Capital and Micro Vest Mauritius Ltd; Rs. 110.00 mn infused by Promoter Group Exit of Lok Capital

2014

Raised floating rate long term unsecured Tier II debt in Jul’14 Raised Rs. 284.37 mn of equity from NMI and USD 10 mn of debt from World Business Capital in the form of ECB

2015

Raised Rs. 414.70 mn from SBI FMO (including warrants) Rs. 378.30 mn infused by Promoter Group

2016

Raised Rs. 2.5 bn via QIP in Oct’16 Exit of DMP in Jul’16 and ShoreCap in Aug’16

2017

Pref. Allotment: Equity funding by NMI (Rs 200 mn), and Kora Cap (Rs. 800 mn); Promoters invested vai FCW (rs 600 mn), Indusind invested Rs (450 mn) vai OCCRPS

2017

In Apr’ 17, raised $10 mn from ADB4 – macking this ADB’s first direct equity investment in a NBFC-MFI in india; Investment of Rs 350 mn by large NBFC in Aug’17; Raised rs. 1.50 bn vai QIP

in Oct,17

2018

Pref. Allotment: Equity funding by NMI (Rs. 20 crore), and Kora Cap (Rs.80 crore); Promoter invested via FCW (Rs 60 crore), IndusInd invested Rs.45 crore via OCCRPS

2019

Exit of MV Mauritius

2020

Successfully completed Rights Issue amidst the pandemic and subsequent lockdowns.

Every great story begins with a seed of thought, an idea that took root in a visionary mind and grew into a possibility beyond imagination. Such was the case of a remarkable young man, who is known and revered as the charismatic founder of one of India’s leading microfinance institutions – Mr. HP Singh of the Satin Creditcare Group (SCNL).

While working as a chartered accountant in Delhi in 1998, Mr. Singh came across several individuals and households purchasing television sets and other items on a ‘rent-to-own’ scheme that allowed the buyer to pay a daily rental amount for a period of time before eventually taking ownership of the item. It was then it struck him that small business owners and grassroots entrepreneurs could also benefit from such a financial scheme as they were unlikely to have large lump sum amounts for capital investment. At a time when Citibank was the only traditional financial institution offering small, unsecured loans to individual entrepreneurs, Mr. Singh set out to cater to a large number of underserved sections of society, with the hope that the loans provided to these low-income households would have lasting impact on their livelihood pattern thanks to the increased income potential, sustained and predictable cash flow; thus subsequently ensuring the societal wellbeing of the household. To do this, he began structuring loan repayments as a daily rather than monthly installment, made it easier for borrowers to deal with at this level. This simple yet brilliant idea was base on which the SCNL business model was built and it continues to flourish till today.

In October 1990, Satin Creditcare was incorporated and commenced operations in East Delhi, widely considered one of the most difficult territories for financial service companies to enter. This once achieved, the company soon expanded all across Delhi, penetrating rural areas through the ‘Grameen Model’ starting May 2008.

The core of SCNL operations is essentially Joint Liability Lending at rural and semi-urban areas, with fortnightly and monthly repayment options for its borrowers. The company aims to provide affordable microcredit for productive activities through both group and individual lending basis. These borrowers typically lack access to funds from other formal financial institutions and taking these loans eventually increase their income generating capacity. As a result, employment, social welfare and a healthy working environment are the happy by-products of SCNL’s operations and the company has a strong presence across North India with clients in Bihar, Chandigarh, Delhi, Haryana, Jammu, Maharashtra, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh, Uttarakhand, Himachal Pradesh, Gujarat and West Bengal.

While it was officially incorporated as a Non-Banking Finance Company (NBFC) when it began, SCNL has since been registered with the Reserve Bank of India as a Non-Banking Financial Company – Microfinance Institution (NBFC-MFI) in 2013. The company went public in June 1994, with IPO shares listed initially on the Delhi, Jaipur and Ludhiana stock exchanges until the time they were de-recognized by SEBI. Following that however, SCNL got listing approval on the Calcutta Stock Exchange (CSE) and went on to successfully list its shares on the National Stock Exchange (NSE) in August 2015 and the Bombay Stock Exchange (BSE) in October 2015.

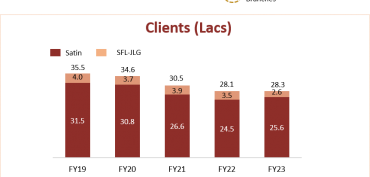

As on March 2022

*Active clients refer to unique number of clients and not to number of loan accounts as on a date, since in some cases, a single client has availed more than one offering from SCNL or TSPL. The definition of Active Client base is valid for each of the entities respectively, however there could be customers who might have availed a loan from both SCNL and TSPL.